Triple witching is the quarterly event when the calendar aligns for all the prominent futures and options contracts to expire on the same day. Investors should understand what happens on triple witching days and be prepared for the greater volume and price volatility that comes with these days. Knowing that can go a long way toward preventing emotional responses to market movements. Single stock futures began trading in November 2002 and each contract represented 100 shares of stock. Single stock futures were legal agreements to buy or sell an underlying stock at a specified price at a specified future date. A stock index option gives its holder the right, but not the obligation, to buy or sell a contract that represents the value of an underlying index on a specified date and at a specified price.

When misalignments surface, traders can engage with the devalued entity and concurrently offload the inflated one, ensuring a profit as price paths intertwine. The intensified tumult during this period augments the emergence of such variances, proffering arbitrageurs with more chances. Triple witching day is consistently one of the most heavily traded days each year. The increased volume tends to lead to higher volatility and intraday price swings and stocks can be unpredictable on Triple Witching day.

- At its core, Triple Witching is the quarterly event when three types of derivative contracts expire all at once.

- Knowing that can go a long way toward preventing emotional responses to market movements.

- Witching days are important because they set expiry prices for so many derivatives, both futures and options, as well as prices for index additions and deletions.

- The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade.

The underlying markets will see volatility in the week leading up to triple witching, but the most active period is the final hour before the market closes on the day, known as the witching hour. This is when parties rush to close their positions, offset them or roll them over. Even those who have only opened speculative positions on the futures or options contracts will need to decide whether to close, offset, or roll over their trade at expiry. In summing up, triple witching stands as a noteworthy event in the financial landscape, shaping unique opportunities and hurdles for market enthusiasts.

What Is Triple Witching Day?

However, due to the risks inherent in triple witching, it’s important for market participants to remain disciplined and adhere to a strict risk-management approach. Due to the convergence of these important expirations, triple witching may also offer insight into potential positioning, which may be valuable to vigilant investors/traders. Stock options are contracts that give the holder the right to buy or sell the underlying security by a specific expiration date and at a specific price, known as the strike price. Durations of available options contracts varies, sometimes with expiries a few years into the future, however options with nearer-term expiries tend to have better liquidity.

Understanding Triple Witching

As these contracts come to a close, traders and investors might decide to close out, renew, or exercise their positions. Triple witching is the synchronized expiration of stock index futures, stock index options, and stock options on the third Friday of March, June, September, and December. It’s pivotal for traders because the convergence of these expirations can heighten market volatility, amplify trading volumes, and present arbitrage opportunities. Triple witching refers to the concurrent expiration of stock options, stock index futures, and stock index options.

New traders will want to be more cautious in the days leading up to and on Triple Witching Friday. However, in 2020, OneChicago, the exchange where single stock futures were traded shut down. While single stock futures trade elsewhere internationally, they no longer trade in the United States. Triple witching underscores the intricate dance of key financial instruments, spotlighting both its benefits and challenges.

In folklore, the “witching hour” actually happens in the dead of night, from 3–4 am. During the Middle Ages, the Catholic Church even banned people from venturing types of dojis outside during this time, so as not to get caught in the chaos. The increased trading volume and volatility can cause prices to fluctuate a lot more than usual.

From Your First Trade to Building a Trading Business

One stock option contract represents 100 shares of the underlying company, so an option quoted at $3.25 would cost the $325. Triple witching refers to the third Friday of March, June, September, and December when three kinds of securities—stock market index futures, stock market index options, and stock options—expire on the same day. Derivatives traders pay close attention on these dates, given the potential for increased volume and volatility in the markets. Triple witching is when the expiration of stock options, stock index futures, and stock index options all fall on the same day.

What is Triple Witching?

It happens only once a quarter and can cause wild swings in volatility, as large institutional traders roll over futures contracts to free up cash. Doing so creates a ton of increased volume—sometimes 50% higher than average, especially in the last trading hour of the day—but individual investors needn’t feel spooked. In fact, some might even view this volatility as a profit-making opportunity. Triple Witching is a significant event in the financial markets that occurs on the third Friday of certain months, typically March, June, September, and December. During Triple Witching, three types of financial derivatives contracts—stock options, stock index futures, and stock index options—all reach their expiration on the same day. Traders and investors must therefore make decisions about their options and futures positions, which can lead to potential shifts (and opportunities) in the markets.

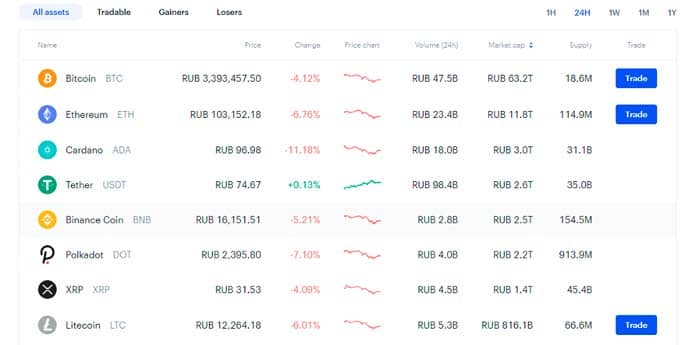

Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. Tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. Tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request.

During triple witching, three different types of financial derivatives contracts—stock options, stock index futures, and stock index options—all expire on the same day. This convergence of multiple expirations can lead to increased trading activity and https://g-markets.net/ volatility in the markets. Triple witching sounds like something from a horror movie, but it’s actually a financial term. Options and derivatives traders know this phenomenon well because it’s the day when three different types of contracts expire.

Single stock futures have an interesting backstory, which we’ll get to later on. The underlying equity index options and futures generally cease trading the day prior (usually a Thursday). But any investors that still hold open contracts will receive profits (through cash settlement) based on the prices set in the next morning’s open auction. That means there remains an overnight risk, but typically no way to hedge gamma (the rate of change in delta hedges required for options to be completely hedged). There can be trading opportunities in both the run-up to, and the day of, a triple witching. You can speculate on whether the price of stocks, stock options, and index futures will rise or fall with FOREX.com.

Triple witching example

Traders and investors need to be aware of this day and its potential impact on their positions and portfolios. Triple witching does not include all of the stock index futures and options contracts, so even though they are the most talked-about expiration events, they are not the only expiration days. Short-term traders should adapt their strategies to these conditions, avoid trading, or reduce their position size if they notice their performance deteriorates during this time.